Hey there! Today, we’re going to talk about something really important in the world of banking – cancelled cheques. Now, you might be thinking, “What in the world is a cancelled cheque?”

Don’t worry, by the end of this article, you’ll be an expert on this super useful banking tool. We’ll cover everything from what a cancelled cheque is, to why you might need one, and even how to cancel a cheque yourself.

How to Cancel a Cheque?

So, let’s dive in!

What Exactly is a Cancelled Cheque?

A cancelled cheque is simply a regular cheque from your chequebook that has the word “CANCELLED” written across it in big, bold letters.

It’s important to note that this doesn’t mean the cheque is void or useless – quite the opposite!

While you can’t use a cancelled cheque to pay for things, it serves as an official record of your banking details.

Here’s what you can find on a cancelled cheque:

- Your name

- Your account number

- The cheque number

- Your bank’s name

Think of it like a business card for your bank account. It’s a safe and secure way to share your banking information when needed.

Why Would You Need a Cancelled Cheque?

Great question! There are quite a few situations where a cancelled cheque comes in handy. Here are some of the main reasons you might need one:

- Setting Up Automatic Payments: If you want to set up automatic bill payments or deposits (like your salary), the company or employer will often ask for a cancelled cheque. This gives them your account details so they can set up the Electronic Clearing Service (ECS).

- Verifying Your Identity: When you’re opening a new bank account or signing up for a financial service, they’ll usually ask for a cancelled cheque as part of the Know Your Customer (KYC) process. This helps them confirm you are who you say you are.

- Applying for Loans: If you’re applying for a car loan or home loan, the lender may request a cancelled cheque. This allows them to set up automatic loan repayments from your account.

- Investing in Mutual Funds: Want to start investing in mutual funds? The fund company will likely ask for a cancelled cheque to verify your bank account and set up a Systematic Investment Plan (SIP).

So as you can see, while you can’t buy your groceries with a cancelled cheque, it’s a super important tool in the banking world!

Step-by-Step: How to Cancel a Cheque?

Now that you know what a cancelled cheque is and why you might need one, let’s talk about how to cancel a cheque. Don’t worry, it’s really easy! Just follow these simple steps:

- Grab a blank cheque from your chequebook. Make sure you choose one from the middle or back of the book, not the next one in line.

- Take a pen (preferably blue or black ink) and draw two parallel lines from the top left corner to the bottom right corner of the cheque. Make sure the lines are dark and go through the entire cheque.

- Write the word “CANCELLED” in big, bold letters between the two lines. Again, make sure it’s written clearly and across the whole cheque.

- Double check that your cheque details (name, account number, IFSC, etc.) are still clearly visible and not covered by the cancellation lines or words.

- Important: Do NOT sign the cancelled cheque! A cancelled cheque should never have a signature on it.

And there you have it – you’re very own cancelled cheque! See, I told you it was easy. Just remember, only cancel a cheque when you actually need to share your banking details with someone. Don’t go canceling cheques left and right for no reason!

Where You Might Need a Cancelled Cheque?

As we talked about earlier, there are quite a few situations where you’ll be asked to provide a cancelled cheque. Here’s a quick recap of some of the most common scenarios:

| Scenario | Why They Need a Cancelled Cheque |

|---|---|

| Setting up automatic bill payments | To get your account details for ECS |

| Applying for a loan | To set up automatic loan repayments |

| Opening a new bank account | For the KYC process to verify your identity |

| Investing in mutual funds | To verify your bank details and set up a SIP |

| New job | For your employer to set up direct deposit of your salary |

So if you find yourself in any of these situations, don’t be surprised if you’re asked for a cancelled cheque. It’s a pretty common request in the financial world.

Cancelled Cheques & Electronic Clearing Service (ECS)

One of the most important uses of a cancelled cheque is setting up an Electronic Clearing Service, or ECS. This is a way to automate regular payments or deposits, like your monthly phone bill or your salary.

Here’s how it works:

- You provide your bank details (via a cancelled cheque) to the company or employer.

- They use those details to set up an ECS mandate with your bank.

- On the scheduled date, the payment or deposit is automatically processed. The money is either taken out of your account (for a payment) or put into your account (for a deposit).

The beauty of ECS is that you don’t have to remember to make the payment or deposit each month – it happens automatically! And all it takes to set it up is a simply cancelled cheque.

Cancelled Cheques & Know Your Customer (KYC)

Another place you’ll often need a cancelled cheque is when you’re completing the Know Your Customer (KYC) process. This is a standard procedure that banks and financial institutions use to verify the identity of their customers.

As part of KYC, you’re usually asked to provide some proof of identity and address, like a passport or utility bill. And more often than not, they’ll also request a cancelled cheque.

The cancelled cheque serves a few purposes in KYC:

- It confirms that you have a bank account in your name.

- It provides the bank with your account details for their records.

- It acts as an additional proof of identity.

So if you’re opening a new bank account or signing up for a new financial service, make sure you have a cancelled cheque handy. It’ll make the KYC process a whole lot smoother.

Fraud Risks & Cancelled Cheques

Now, while cancelled cheques are super useful, it’s important to remember that they do contain sensitive banking information. And in the wrong hands, that information could potentially be used for fraudulent purposes.

Here are a few ways fraudsters might try to misuse a cancelled cheque:

- Forgery: They could try to forge your signature onto a new cheque, essentially allowing them to steal money from your account.

- Identity Theft: They could use the information on your cancelled cheque (like your name and account number) to steal your identity and open new accounts or take out loans in your name.

- Fake Cheques: They could create fake cheques using the details from your cancelled cheque, and try to cash them or use them for fraudulent purchases.

Scary stuff, right? But don’t worry, there are steps you can take to protect yourself:

- Only Cancel Cheques When Necessary: Don’t hand out cancelled cheques like candy. Only cancel a cheque when it’s required, like for setting up ECS or completing KYC.

- Keep Your Cheques Safe: Always store your chequebook (and any cancelled cheques) in a secure place, like a lockbox or a safe. Never leave them lying around in public places.

- Destroy Old Cheques: If you have any old cancelled cheques that you don’t need anymore, destroy them properly. Use a paper shredder or cut them up into tiny pieces before disposing of them.

- Report Lost or Stolen Cheques Immediately: If you ever lose a cheque or suspect that one has been stolen, contact your bank right away. They can block the cheque and prevent any fraudulent transactions.

By following these simple precautions, you can enjoy all the benefits of cancelled cheques without putting yourself at risk for fraud.

Cancelled Cheques vs. Dishonoured Cheques

Before we wrap up, let’s quickly discuss the difference between a cancelled cheque and a dishonored cheque. While they might sound similar, they’re two very different things.

As we’ve learned, a cancelled cheque is a regular cheque with “CANCELLED” written across it. It can’t be used for payments, but it’s still a valid document that contains your banking details.

A dishonoured cheque, on the other hand, is a cheque that the bank refuses to honor. This could happen for a few reasons:

- Insufficient Funds: You don’t have enough money in your account to cover the cheque amount.

- Incorrect Details: The cheque has incorrect information, like a wrong signature or date.

- Stale Cheque: The cheque is too old. Banks typically don’t accept cheques that are more than 3-6 months old.

If a cheque is dishonoured, the bank will usually stamp it with a “bounced” or “returned” mark and send it back to the person who tried to cash it. They’ll also charge a fee to your account for the bounced cheque.

So remember, a cancelled cheque is still a valid document, while a dishonoured cheque is useless. Make sure you always have enough funds in your account and double-check your cheques before writing them to avoid any bounced cheque situations!

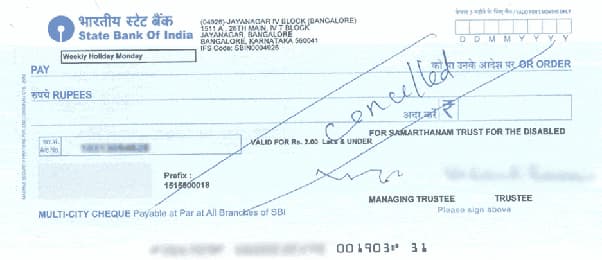

Cancelled Cheques Pictures:

Also Check: PAN Card Status

Wrapping It Up:

Phew, that was a lot of information! But you made it through, and now you’re a total pro when it comes to cancelled cheques. Let’s quickly recap what we’ve learned:

- A cancelled cheque is a regular cheque with “CANCELLED” written across it.

- Cancelled cheques are used to safely share your banking details when needed, like for setting up ECS or completing KYC.

- To cancel a cheque, draw two lines across it and write “CANCELLED” in between. Don’t sign it!

- Cancelled cheques contain sensitive information, so only cancel them when necessary and always keep them secure.

- A dishonoured cheque is different from a cancelled cheque – it’s a cheque the bank refuses to honor, usually due to insufficient funds.

Armed with this knowledge, you’re ready to navigate the world of cancelled cheques like a banking boss. Just remember to always use them responsibly and keep them safe.